Top 9 Student Loans For Community College [Compare the rates offered]

Picking the right student loan for community college isn't like picking a loan for university. Not all community colleges accepted student loans from the federal government or from private lenders.Choose the right loan from our list and learn more about how to pick the right lender.

Updated by Jason Joy Manoj on 23rd December 2019

Attending community college has a number of advantages, apart from the obvious financial advantage you get by attending your local junior college you get a chance to start exploring courses that are of your interest. You can set up a schedule that is best suited for you, with these advantages you can figure out what you want to major in. Most students are confused about which major to take up or when they do take up a major they are still in doubt.

If you seek student loans for community college then it is advisable to max out on your federal options first then start looking for private loans. Keep private student loans as a last resort but once you reach this last resort it is advised to carefully evaluate your options.

Table of Contents

- Top 9 student loans for community college

- Choose the right lender

- Is community college free

- Private student loans for community college

- Overlooked loan options

Top student loans for community colleges

Community colleges have a lot to offer in terms of value for education at a much lower cost. In spite of the low tuition cost, a student must cover living expenses which are still quite a lot. Here is a list of the top student loans that can help you cover these additional expenses.

1) Rhode Island State Loan Authority

RISLA offers a number of advantages to their student loan borrowers some of them being -

-

An option for the borrower to choose when to start repaying the loan

-

There are no origination, application or upfront fees

-

They provide a number of borrower protections, this is through the income-based repayment plan they offer which helps make the payments become more affordable.

-

They provide a cosigner release option after 24 months of consecutive on-time payments

-

You can borrow the loan in the students or the parent’s name

Interest rates offered

They offer fixed rate interests of 3.64% and 5.64% for student immediate repay and student deferred repay respectively..

You can avail a 0.25% interest rate reduction if you enroll for automatic monthly payments

Loan limits

The loan limits offered is a minimum of $1,500/yr to a maximum of $45,000/yr.

Minimum credit score

They require a minimum credit score of 680

Learn more about Rhode Island Student Loan Authority (RISLA), to find out if it is the right lender for you.

2) Earnest

Earnest is best known for -

-

Not charging a late fee

-

Providing customizable payment options

-

Providing customizable loan terms

-

Allowing multiple extra payments

Interest rates offered

Fixed interest rates ranging from - 4.49% to 12.78%

Variable interest rates ranging from - 2.79% -11.44%

Loan limits

Earnest offers loans which vary from $1000 to the school’s cost of attendance

Minimum credit score

The minimum credit score required is 650

Learn more about Earnest student loans

3) Federal Subsidized/ Unsubsidized loans

These are federal loans provided to those eligible students to cover expenses, they are funded by the Government and given out by the US Department of education. These loans are also known as Stafford Loans or Direct Stafford Loans.

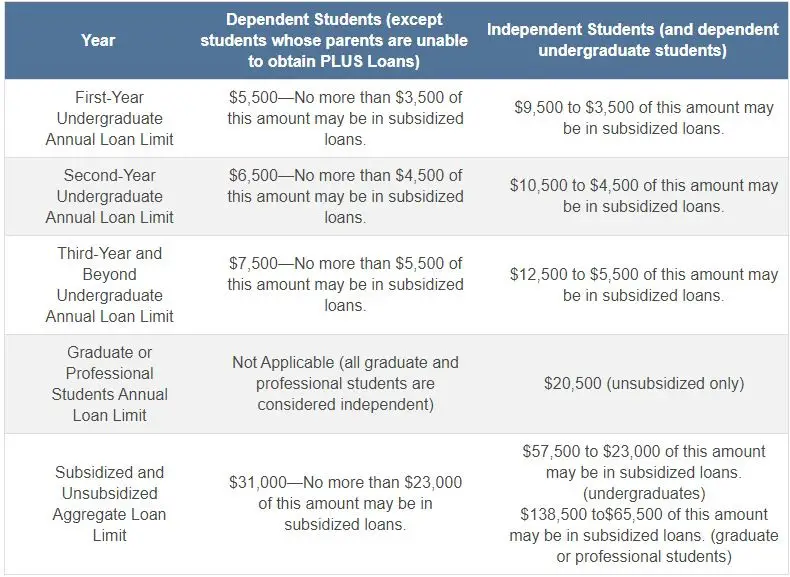

Loan limits

The school decides the loan limit which the student loan borrower is eligible to receive for each academic year. The limits on the unsubsidized and unsubsidized loans are different, there are chances of borrowers being eligible for an amount less than the annual loan limit.

The limits can vary depending upon whether the borrower is a dependent or independent student and what year the student is in.

As per the official Federal student aid website here are the loan limits -

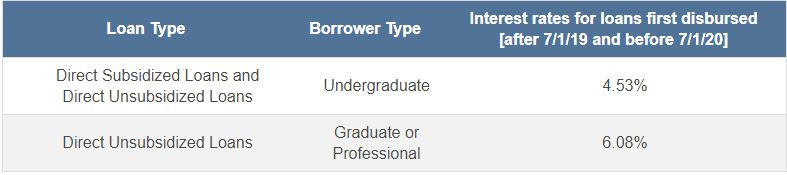

Interest rates

The interest rates offered as per the official Federal student aid website is -

Minimum credit score

Federal loans do not require a minimum credit score.

Learn more about your federal student loan options

4) Sallie Mae

Sallie Mae is a great option for student loan borrowers as they provide -

-

Multiple repayment options

-

Competitive interest rates

-

No origination fee

-

No prepayment penalty

Loan limits

Sallie Mae approves loans from $1,000 to the total cost of education incurred by the student. The total cost of education minus the expenses covered by Federal Stafford loans. The maximum limit is $200,000.

Interest Rates

The interest rates offered are -

-

Fixed rates ranging from 4.74% to 11.35%

-

Variable rates ranging from 2.75% to 10.22%

Minimum credit score

Sallie Mae hasn’t disclosed a minimum credit score requirement. It should be noted that in 2016 applicants who were approved for a Sallie Mae student loan had an average 748 FICO score.

Learn more about Sallie Mae Student loans

5) Lendkey

The notable features of Lendkey are -

-

They offer low-interest rates

-

They offer a comparison of their offers to help you choose the right option

-

They have an in-house customer service team

Loan limits

The loan amounts offered by Lendkey vary from $5,000 to $125,000 for undergraduate degrees, up to $250,000 for graduate degrees. Students who are pursuing medical, dental or veterinary degrees can get loans up to $300,000.

Interest rates

The interest rates offered by Lendkey are -

-

Fixed interest rates vary from 4.99% to 10.49%

-

Variable interest rates vary from 3.84% to 10.56%

Minimum credit score

In order to get qualified with Lendkey you need to have a minimum credit score of 660

Learn more about Lendkey student loans

6) PNC Private Student Loans

PNC provides the following benefits to its student loan borrowers -

-

The preliminary decision will be given within minutes after applying online

-

You can choose between a fixed and variable interest rate

-

There is no application fees or origination fees

-

You can avail a 0.50% off on your rate by registering with automated payments from your account

-

With Lendkey you have flexible repayment plans

-

You have an option for co-signer release after 48 consecutive on-time monthly payments

Loan limits

Annually you have a maximum borrowing limit of $50,000 and for your total education debt you have a limit of $225,000 which is including federal and private student loans

Interest rates

The interest rates offered by PNC are

-

Fixed interest rates vary from 5.61% to 11.79%

-

Variable interest rates vary from 5.15% to 11.30%

Minimum credit score

The minimum credit score required is 670

7) Wells Fargo

The benefits of choosing Wells Fargo as your student loan lender -

-

Students need to start repaying the loans, only within 6 months after leaving schools.

-

Students can even make early payments even while they are at school.

-

There is no requirement of application, origination or prepayment fee.

Loan limits

The minimum amount you can borrow is $1,000 and the maximum amount you can borrow is $120,000

Interest rates

The interest rates offered by Wells Fargo are -

-

The fixed rates vary from 5.94% to 11.96%

-

The variable rates vary from 5.04% to 10.93%

Minimum credit score

Wells Fargo hasn’t disclosed any minimum credit score.

Learn more about Wells Fargo Student loans

8) Navy Federal Private Student Loan

Student loan borrowers who take Navy Federal Private Student Loans can expect the following -

-

Building a good credit history by making your payments with the help of the various repayment options available

-

Reduction of overall costs

-

Borrow an amount up to the school-certified cost of attendance

-

You get a co-signer release option after making 24 consecutive and on-time principal and interest payments

Loan limits

The loan amounts offered by the Navy Federal Credit Union vary from a minimum of $2,000 minimum to $120,000 for undergraduates and for $160,000 for graduate students.

Interest rates

The interest rates offered were -

- Fixed rates varying from 6.49% to 12.84%

- Variable rates varying from 5.32% to 11.72%

Minimum credit score

The Navy Federal Credit Union has not disclosed a minimum credit score for approval

Learn more about the Navy Federal Credit Union

9) MPOWER Private Student Loan

MPOWER is known for providing student loans for international and DACA students. When you take loans with MPOWER you can expect the following benefits -

-

Forbearance of 24 months is offered which is more than what most lenders have to offer

-

Provides a non-cosigned option for international and DACA students

Loan limits

The loan limits offered have a minimum of $2,001 and a maximum of $50,000. A student loan borrower can only borrow up to $25,000 per academic period.

Interest rates

A fixed interest rate is offered, varying from 7.52% to 13.63%

Minimum credit score

There is no minimum credit score disclosed

Learn more about MPOWER student loans

How to choose the right student loans for community college?

Now that you know the right choices to help fund community college, here are some points to help you decide on the right loans. It is always advised to exhaust yourself of your federal options, grants and much more before exploring your private student loan options -

1) Explore grant options - It is advised to fill out your FAFSA form as soon as possible after October 1st when the FAFSA applications open. You can get access to financial aids like the Pell Grant.

If you qualify for this Grant then you can cover most of the costs for community college, the money got from grants need not be repaid. Upon filing the FAFSA you can get access to state and school grants.

2) Explore federal loan options first - When compared to the private student loan options these federal student loan options come at a lower interest rate. Later on, when you reach the repayment phase of your loans, with federal student loans you can qualify for income-based repayment which helps in making your payments more affordable.

But it should be noted that not all community colleges participate in the federal loan program.

3) It is advised to build your credit or get a cosigner on board while getting a private student loan to get the best rates - Even after exhausting all your federal options if you still have a financial gap, private student loans are your last resort. In order to get good interest rates for your private student loans, it is advised to build a good credit score or get a cosigner with good credit on board. Better the credit lower will be the interest rate you qualify for.

4) Check if your school is eligible for the loans you qualify for - Most lenders offer loan options only for degrees at four-year schools only. It is advised to explore your options by making sure that the community college that you are attending is on the private lender’s list of eligible schools.

Even if you are going to enroll at a reputed and good community college, if they do not accept funding through the federal government or through private sources, it is a waste of time.

5) Compare the available loan features - It is always advised to look for the loan with the lowest interest rate you can qualify for. Another important feature to look out for is the repayment flexibility offered.

If your lender can postpone your payments given the scenario that you find it difficult to meet payments. Co-signer release is another important feature to look out for.

6) Prefer a fixed interest rate - Fixed interest help make the payments to be made more predictable. The variable interest rates change as per the market do your payments can increase over time.

7) Have an idea of how much you will have to start paying each month - use a student loan calculator to find out how much you will have to make as payments each month. This helps in planning the repayment journey throughout the life of the loan.

Is community college free?

The number of states passing laws that push towards tuition-free community college for the in-state resident has increased. Schools and cities have also started to offer programs that help make public college more affordable.

Some of the programs first check if you have tried exhausting yourself of the federal and state grants, hence it is advised to fill out the Free Application for Federal Student Aid (FAFSA). Apart from the tuition expenses, you will still have to cover other expenses like the living expenses, food, transportation, books and other fees incurred during the course of study.

Private student loans for community college

A majority of the private lenders focused on providing private student loans for those students attending a 4-year course at college. With the change in trend more and more number of students are focused on enrolling at a community college. To keep up with this trend the private lenders have started offering education loans to those students who are attending a community college or a technical school, which is for 2 years.

When compared to a federal loan the private student loans are offered based on the applicant's credit score. Which makes it difficult for a student with little or even no credit history. This is where a cosigner is got onboard, but there are certain risks of getting a co-signer on board. The cosigner starts to share the burden of debt and if the payments are not made on time then the credit score of the cosigner will be affected.

Student loan borrowers who are considering taking private student loans should keep in mind the higher interest rates, origination fees, and prepayment penalties. Dealing with private student loans is more expensive at an overall consideration. They also set a minimum borrowing limit on the student loans offered. This leads to students borrowing more than what they need to cover their college costs.

You may have overlooked these student loans for community college

There is financial aid offered at a state level which is often overlooked by student loan borrowers. Some state governments directly fund the loans through their state programs while others work with private student lenders. These private lenders are state-certified, state-approved student loan providers.

Student loans are a great option to help fund your education. While searching for the best student loans to fund your education it is always advised to look out for all the options available to you and pick the one that best suits your financial condition.

93.jpg)

28.jpg)