Student Loans For Immigrants

Many lenders offer student loans for immigrants, even student loans for undocumented immigrants and non US citizens.

Updated by Priya shah on 11th November 2021

Several loan providers offer loans to immigrants, provided they meet certain eligibility criteria. Even some undocumented immigrants could be eligible for certain loans, depending on their state of residence.

It’s easy to assume that immigrants can’t access the same student loans as US citizens; but the opposite is true. There are even some student loans designed specifically for immigrants.

Read on to find out more about student loans for immigrants, student loans for undocumented students, and FAFSA requirements, and FAFSA eligibility for immigrants.

Table of Contents

FAFSA for Immigrants

Student Loans for Immigrants

Student Loans for Undocumented Immigrants

FAFSA for Immigrants

FAFSA is only available to US Citizens and eligible non-US citizens. So, undocumented immigrants are certainly ineligible for federal financial aid, including federal student loans.

Eligible non-citizens might include US nationals, permanent residents, and immigrants in the US with refugee or asylum status. If you’re wondering, “Can green card holders, or permanent residents, get federal student loans,” the answer is yes!

Other eligible immigrant groups for federal student loans include the following:

- T-visa holders for victims of human trafficking

- Children of parents with T-1 nonimmigrant status

- Battered Immigrant-qualified aliens, or victims of spousal abuse

- Citizens of the Republic of Palau (with limitations)

- Citizens of the Federal States of Micronesia (with limitations)

- Citizens of the Republic of the Marshall Islands (with limitations)

Unless you fall in one of the above categories, you likely don’t have FAFSA eligibility. But that doesn’t mean there aren’t any student loans for immigrants. Consult with your college of choice to find out if there is any way for you to be eligible for federal aid, or if they would recommend other options.

Student Loans for Immigrants

There are plenty of immigrant-specific loans offered by private lenders. However, many of them require applicants to have a cosigner who is a permanent resident or US Citizen, a luxury not available to many immigrant applicants. The cosigner must also have good credit standing to be considered for the loan. Luckily, there are also some student loans specifically dedicated for immigrants without a cosigner.

Student Loans for Immigrants that Require a Cosigner

1. College Ave

|

College Ave Immigrant Student Loan Specifications |

|

|

APR Interest Rate |

0.99%-12.99% |

|

Loan Limits |

Up to the total cost of attendance |

|

Term Length |

5, 8, 10, or 15 years |

College Avenue offers student loans only to immigrant students that have a US social security number. They also require the applicant to have a cosigner that is either a US citizen or a permanent resident.

2. Ascent

|

Ascent Immigrant Student Loan Specifications |

|

|

APR Interest Rate |

Variable: 1.50% – 9.58% Fixed: 2.97% – 11.44% |

|

Loan Limits |

Assumed up to the total cost of attendance, since no limit is listed on their website |

|

Term Length |

5, 7, 10, 12 or 15 Years |

Ascent usually provides student loans without the requirement of a cosigner, but that’s only for US students. Immigrant applicants must apply with a cosigner.

3. Citizens Bank

|

Citizens Bank Immigrant Student Loan Specifications |

|

|

APR Interest Rate |

|

|

Loan Limits |

|

|

Term Length |

Citizens Bank offers student loans to immigrant applicants; however, their specific requirements aren’t readily available on their website. To find out more info, we recommend you contact them.

Student Loans for Immigrants that Don’t Require a Cosigner

1. Stilt

|

Stilt Immigrant Student Loan Specifications |

|

|

APR Interest Rate |

7.99%-35.99% |

|

Loan Limits |

Up to $35,000 |

|

Term Length |

6-24 months |

Stilt offers loans to immigrants, both visa-holders and undocumented immigrants. They look at applications holistically, and are interested in the applicant’s employment information, education, records of bankruptcies and defaults, as well as their credit score.

Although Stilt doesn’t require a cosigner, their loan terms are much more aggressive than a lender that does require one. You won’t find interest free loans for immigrants here. Applicants can expect to pay 3 times if not more the cost of interest compared to other lenders. The repayment term is also much more stringent, maxing out at two years.

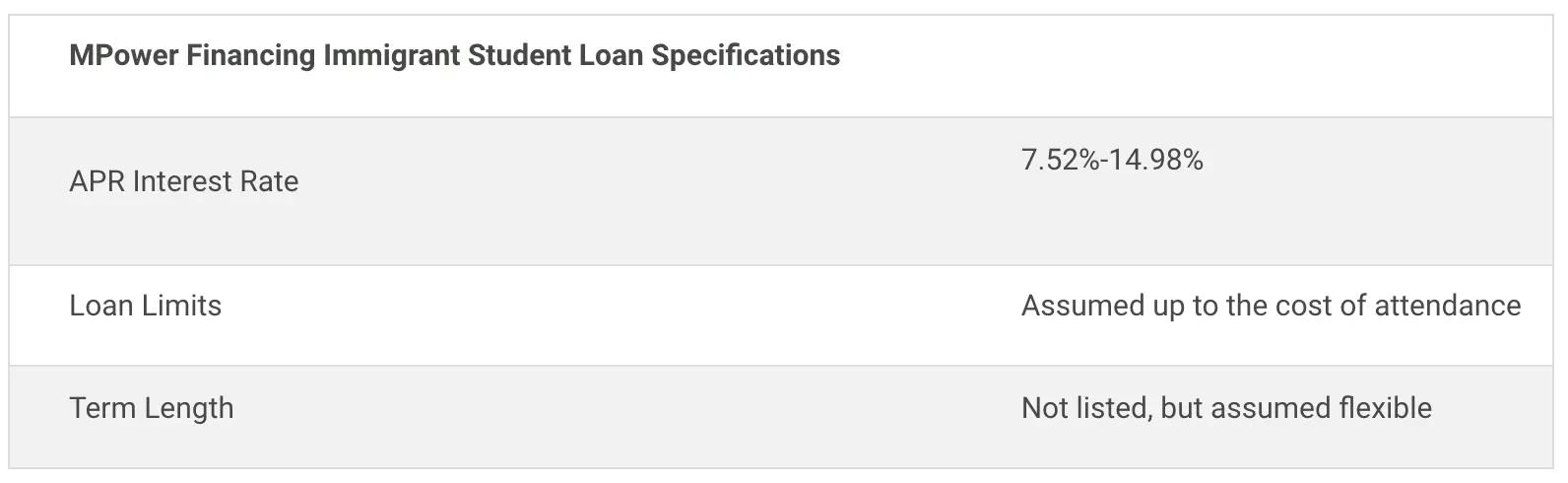

2. MPower Financing

MPower Financing offers student loans for immigrants without requiring credit history or a cosigner. Their requirements include:

- DACA Recipient

- Proof of college acceptance

- Current or prospective undergraduate or graduate student within two years of graduation

Immigrants that don’t have a cosigner might consider applying for personal loans; however, these loans will almost always have a higher interest rate.

Documents Required for Immigrants Applying for Student Loans

Immigrant applicants might be required to provide more documentation and information to be considered for private student loans. Some examples of information lenders might request include:

- Proof of college acceptance

- Documentation of approved visa

- US address

Conclusion

Contrary to the assumption of many, there are plenty of student loans for immigrants. We’ve listed a few, but we encourage you to look at other lenders and inquire about their offerings for immigrant students. You might also consider applying for a scholarship for non-US citizens, to help you with your educational costs.

93.jpg)

28.jpg)