What Percentage Of College Students Receive Financial Aid

If you are looking to know how many college students receive financial aid? Then you have hit the right spot. Learn more about it in this article.

As there are various kinds of financial aid available for aspiring and deserving students, you might also think about how many college students receive financial aid? According to NCES statistics, it is observed that 85% of college students receive financial aid. It can be shocking for many families as the tuition fees can be overwhelming and because of financial trouble, many students often drop out of the schools. For the growing number of students who are unable to pay their tuition fees completely, the number of financial aid grants has grown thus making higher education affordable.

What Is College Financial Aid And How Does It Work?

College financial aid helps both students as well as their families by covering higher education expenses, such as tuition and fees, room and board, books and supplies, and transportation.

Let us look at the types of Financial Aids offered

-

Grants

-

Scholarships

-

Work-study

-

Federal or private loans

The various types of aid are provided by multiple sources, such as federal and state agencies, high schools, colleges, corporations, and foundations. Depending upon the guidelines by federal, state, and institutions, the amount of aid a student receives is decided.

One thing to be kept in mind always is the way federal financial aid works. The students must apply for aid by answering several questions used to determine their ability to pay for college.

The aid is then awarded based on the student's application, and they have the choice to either accept or reject the aid offered. The type of aid offered determines whether it has to be repaid. Students need to complete additional applications to be considered for other scholarships or private aid.

What Percentage Of College Students Receive Financial Aid?

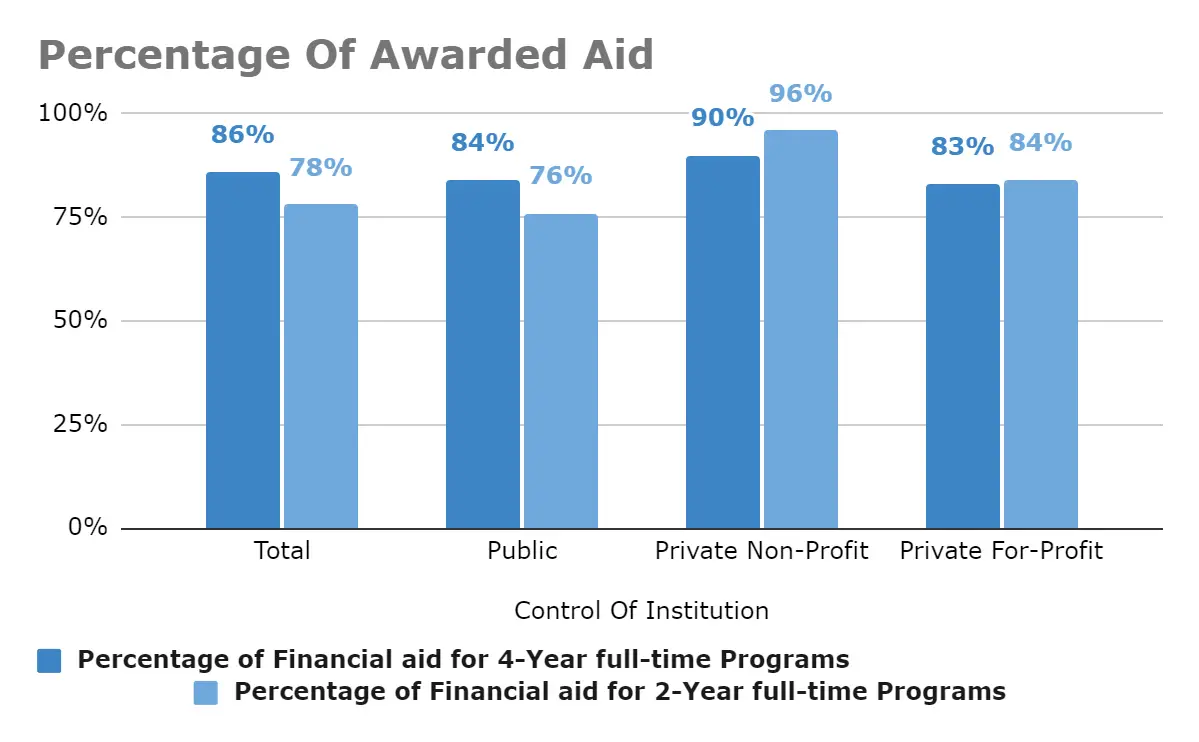

According to a study by the National Center for Education Statistics, 85% of students receive some form of financial aid to help with the escalating costs of college. The chart below shows the percentage of financial aid for a full-time 4-year program as well as a 2-year program offered by different institutions.

It is observed that in total 86% of financial aid is awarded to the college students for a 4-year, full-time degree program. And 78% of financial aid is awarded to the college students for a 2-year degree program. Going further it is observed that the public, private non-profit, and private for-profit institutions offer 84%, 90% and, 83% of financial aid for a 4-year, full-time degree program. Similarly, for a 2-year degree program, the public, private non-profit, and private for-profit institutions offer 76%, 96%, 84% respectively.

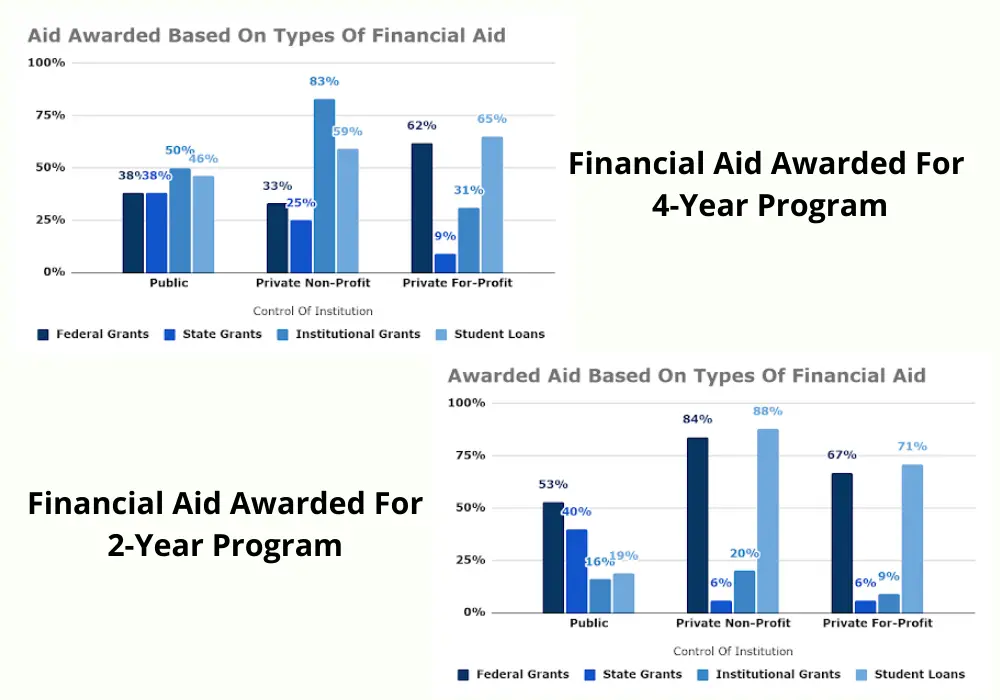

Percentage Of Awarded Aid Based On The Type Of Financial Aid For 4-Year Degree Program

Now that you know the percentage of aid awarded every year by the colleges and universities of various kinds. Let us further breakdown and see what is the percentage of aid awarded based on the type of financial aid for a 4-year degree program.

The chart shows there are 38% of federal grants by public institutions, and 33% and 62% federal grants for private for-profit and private non-profit institutions respectively. Similarly, state grants for public, private non-profit, and private for-profit institutions offer 38%, 25%, and 9% respectively. 50%, 83%, and 31% of institutional grants are awarded by the public, private non-profit, and private for-profit institutions. Finally, the student loans offered by the public, private non-profit, and private for-profit institutions are 46%, 59%, 65% respectively.

Percentage Of Awarded Aid Based On The Type Of Financial Aid For 2-Year Degree Program

Similarly, check out what is the percentage of aid awarded based on the type of financial aid for a 4-year degree program. Based on the chart given above for a 4-Year degree program it is observed that there are 53% of federal grants by public institutions, and 84% and 67% federal grants for private for-profit and private non-profit institutions respectively. Similarly, state grants for public, private non-profit, and private for-profit institutions offer 40%, 6%, and 6% respectively. 16%, 20%, and 19% of institutional grants are awarded by the public, private non-profit, and private for-profit institutions. Finally, the student loans offered by the public, private non-profit, and private for-profit institutions are 19%, 88%, 71% respectively.

Ways To Process Financial Aid For College Students

The process may seem to be a straightforward statistic. It can also get complicated to process financial aid sometimes.

However, there is much more at play than the simple transfer of money. If we look at the number of students who receive financial aid, the money often comes from various programs and organizations, as opposed to one centralized source. There are various ways in which college students can receive financial aid. It is thus important for us to understand the different routes available for monetary relief.

Many students receive student loans

The most familiar routes students can take is through a for-profit student loan organization, such as the SLM Corporation or Sallie Mae. The for-profit SLM organization was worth $1.8 billion in total equity in 2014. As of the current year, it uses a division under the name of Navient to manage their student loans.

Navient provides funds to nearly 12 million students nationwide. Navient points out that the financial aid program on their website has been paid off by one out of three customers who used it. The students are much more likely to have good credit lines than their peers who go through Navient more than two times. Navient also states that their alumni are 65% more likely to work full time.

Federal Aid Programs for students

Although Navient is not connected to the US government directly, Washington runs its own federal aid program to help the students in need. The financial aid provided by the government is the Free Application for Federal Student Aid, also known as the FAFSA program.

About 13 million students are provided with nearly $150 billion for aid and rosters, and over a thousand employees nationwide through FAFSA. Hence, students must fill out the FAFSA form to see if they qualify for government assistance irrespective of their educational background.

Consider the Federal Work-Study program as an option

A less formal route is the Federal Work-Study (FWS) program that helps them to find jobs through campus, earn money to help with their steep education price tags. Students can start paying off their student loans while still in college after they qualify for work-study. In comparison, those who wait to settle their bill until after graduation end up paying more. There are variations in work-study jobs based on several factors. You must be accepted first to qualify.

Conclusion

85% of students receive some form of financial aid and are offered help with the escalating costs of college. Thus, student loan costs are a critical issue in the current environment. Perhaps, for those who seek to get financial aid, there are always ways to receive it irrespective of the path you walk to get there.