How Long Does It Take to Get a Student Loan?

Wondering how long does it take to get a student loan? Read more to learn about your student loan timeline and processes.

Updated by Akshata Patil on 15th October 2021

So you applied for a student loan and just found out you were approved. Congratulations! You’re one step closer to embarking on your dream educational journey. Or, perhaps you’re planning to apply for a student loan and aren’t sure about the student loan timeline.

Either way, you must be wondering: when do I get my student loan money? How long does it take to receive a student loan?The answer to that question depends on many factors, including the type of loan, lender, and whether it’s a federal student loan or private student loan.

Major student loan lenders in the US are the federal government and private financial institutions. But when does student loan come in? The process of disbursement varies for both types of lenders, and so does the time to get the funds.

Getting a student loan is a three-step process. The first is the application process, the second is approval, and the final is the loan disbursement.

Table of Contents

- How Long Does it Take to Receive a Student Loan: Federal Student Loans

- How Long Does It Take to Get Student Loans: Private Student Loans

- When Should I Apply for Student Loans?

How Long Does it Take to Receive a Student Loan: Federal Student Loans

Wondering, “how fast can I get a student loan,” specifically for federal student loans? Generally, federal student loans take anywhere between a few weeks to a few months to arrive.

The first step of obtaining a federal student loan is the Free Application for Federal Student Aid (FAFSA). The federal government will process your application process within three to five days.

The next step is the financial aid award letter, which you’ll receive from the schools you listed on your FAFSA. You’ll receive this after your Student Aid Report (SAR) is shared with your listed schools. The financial aid award letter will come within three weeks after you submit your FAFSA. If you haven’t heard anything after three weeks, we recommend reaching out to the college’s you listed on your FAFSA.

The final step for getting a federal student loan is disbursement, which usually occurs at the beginning of each school term.

Example with Dates for Federal Student Loan Process

Let’s break down this timeline as though you were attending college fall 2022. Your FAFSA deadline is on June 30, 2022. If you apply by then, your application will be processed by July 7th, 2022, latest, assuming the federal government doesn’t experience any delays.

With a three-week waiting period for the financial aid award letter, you’re likely to receive it on July 28, 2022. And, with federal loans typically dispersed at the start of the school term, you’d likely receive the loan by early September, 2022.

How Long Does It Take to Get Student Loans: Private Student Loans

Wondering, “how long does it take to process a student loan,” specifically for private student loans? Generally, private student loans take three weeks to two or three months to arrive. The higher end of that range is only applicable to loan applications that experience significant delays. Usually, private student loans arrive within a few weeks.

Each private lender has different application guidelines for their loans. Since they are more profit-oriented, they are more likely to secure a contract agreement with you quickly, at least more quickly than the federal government.

Always shop around when it comes to private student loans. Ask about interest rates, loan repayment periods, student loan cosigner rules and cosigner release, deadlines, and any other information you need to make your decision. In those inquiries, you can request information about the student loan timeline as well.

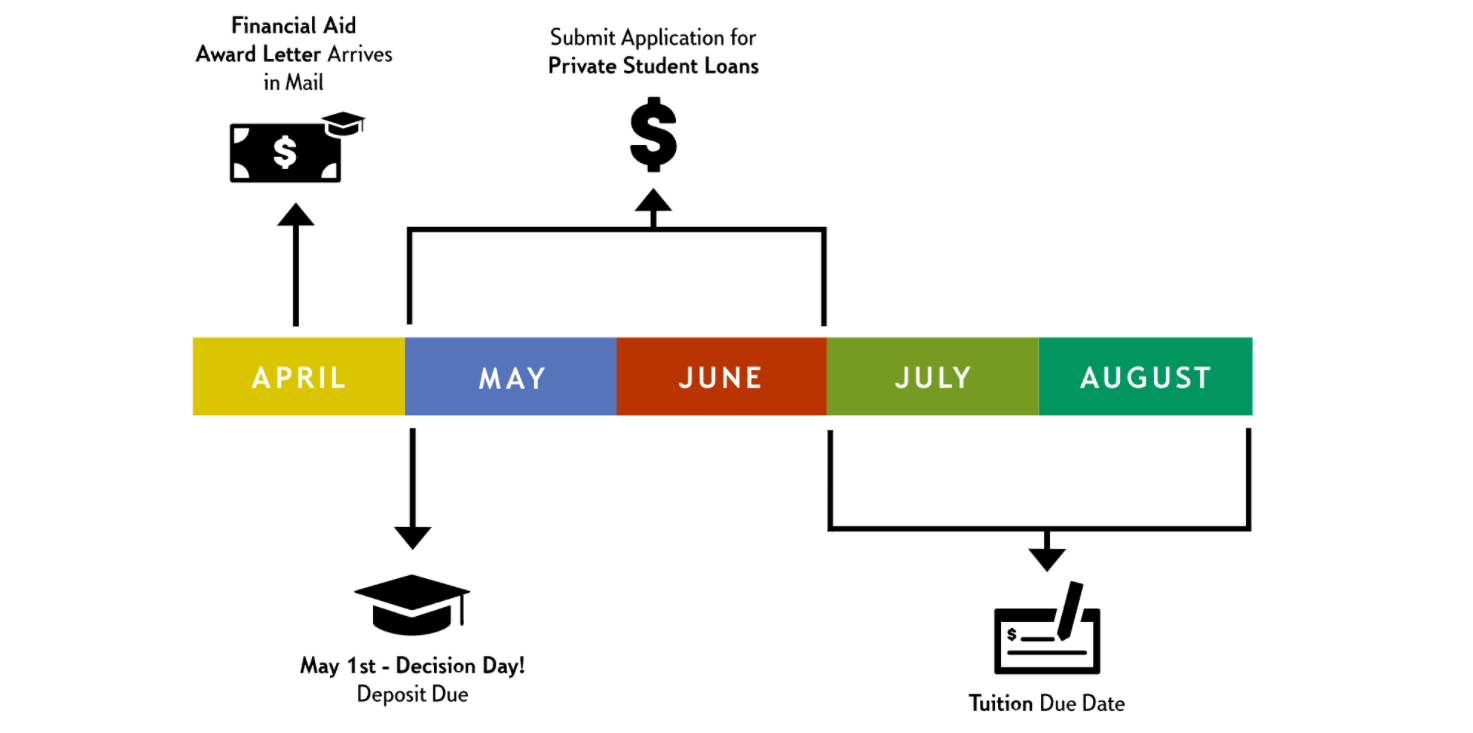

Source: Citizens Bank

When Should I Apply for Student Loans?

It’s always a good idea to apply for things early. But when it comes to student loans, how early is necessary? The answer depends on whether you’re applying for a federal student loan or a private student loan.

When Should I Apply for Federal Student Loans?

The simple answer? As soon as possible!

Federal student loans are at greater risk of delays than private student loans, so it’s best to get a head start. The FAFSA is due on June 30; but, that doesn’t mean you should wait that long to send in your application! Every year, the FAFSA is available on October 1st, so you should send your application close to that date.

When Should I Apply for Private Student Loans?

Private student loan lenders often have their own deadlines and requirements. Generally though, you can apply for a private student loan at any time, even in the middle of the school year. Aim to apply at least two months before your semester starts, to give yourself some leeway for the low chance of a delay.

Frequently Asked Questions (FAQs)

1. How Do I Know if my Student Loan is Approved?

You can find out whether or not your student loan is approved by checking your loan status.

For federal student loans, log into your FAFSA account to check your status. On the “My FAFSA Page,” you should be able to check your status with your loan servicer.

For private student loans, you must contact your lender to find out if you’ve been approved.

2. Is it Hard to Get Approved for a Student Loan?

It’s harder to obtain approval for some student loans but not for others. For example, if you have poor credit and little employment or income history without a cosigner, it’s likely that you won’t be approved for a student loan with a competitive interest rate. But, you might be approved for a loan with less favourable terms.

3. Does Everyone Get Approved for Student Loans?

Not everyone, but most Americans do get approved for student loans. In 2019, 69% of students took out student loans. The remaining 31% either weren’t approved, weren’t eligible, or simply did not need the loan.

4. What Can I Do if my Student Loan is Denied?

If your student loan is denied, don’t fret. Here are some things you can try to gain approval next time:

- Improve your credit score

- Get a cosigner

- Lower your borrow amount

- Start with federal student loans

Conclusion

So, if you’re wondering “when does my student loan come in, ” the answer varies. You can expect the student loan timeline to range from a few weeks to a few months.

93.jpg)

28.jpg)