How to Become an Accountant in 8 Steps

Fulfill your career dream in managing finances and taxes for individuals and businesses with this guide on how to become an accountant.

Accounting is a vast field of work. As a business language, accounting helps us record, communicate, and communicate financial information within the parameters of a country’s finance and tax laws. Accountants must have a strong sense of responsibility, a knack for numbers, and an eye for detail. If you’re considering a career as an accountant, now’s just as good a time as any—people will always make money, therefore people will always need accountants. The demand, job security, and stable income are always present within the accounting field.

Wondering how to become an accountant? What do you need to be an accountant? We’ll answer both those questions, along with, “how long does it take to become an accountant,” “do I need a degree to become an accountant,” and “what are accountant requirements?”

Steps to Becoming an Accountant

-

Complete High School or Obtain your GED

To be an accountant, especially a chartered professional accountant (CPA), you usually need a bachelor’s degree. Take the time to finish up your high school and obtain a decent final grade to heighten your chances of admission to a college. Consider getting your GED if you didn’t complete high school.

-

Enroll in an Undergraduate Program

Time to enroll in a bachelor’s degree program. Most accountants enroll in a Bachelor’s of Accounting, where they take courses about tax laws, financial management, and business. Some popular course topics within this degree include recordkeeping, statistics, business tax, auditing, international finance, and personal tax.

Throughout your degree, try to find opportunities to improve your communication skills. Join study groups, attend office hours, get involved with student associations, and network. Other skills necessary to become a successful accountant include:

- Organization skills

- Numerical skills

- Leadership skills

- Ethics

- Time management

- Computer skills

-

Narrow Down Your Career Path

Like we mentioned, accounting is vast. There are different kinds of accountants and different types of tax professionals. For example, you can specialize in auditing, financial accounting, or tax accounting. You might decide to go the long mile and work towards your CPA designation or work as a bookkeeper.

You might also start considering your ideal work environment. Would you enjoy working with a government agency? Or perhaps a private company? Do you aspire to be an accounting consultant or entrepreneur with your own practice? These are things to think about when considering what you want out of accounting.

Here are some other subfields of accounting to consider.

Auditing

Auditing is concerned with ensuring companies are held to financial standards.

As an internal auditor, you would sift through financial records to ensure a company follows all tax laws and regulatory statutes.

As an auditing manager, you would oversee other auditors’ work activities and provide leadership to the auditing team.

As a fraud examiner, you can expect to have a varied set of responsibilities. While corporate professionals are brought in to complete internal investigations, those that work with governmental agencies typically do external investigations.

Taxation

Those that are interested in taxation will gain knowledge of practices and procedures associated with the tax code. As a tax specialist accountant, you have many job opportunities, like corporate tax accountant, personal accountant, or tax consultant.

As a corporate tax accountant, you may work with both small and large organizations. You would be responsible for preparing tax documents aligned with federal regulations.

As a personal accountant, you would prepare tax documents for individuals. You can either be employed by an accounting firm or be self-employed.

As a tax consultant, you will be specialized in a specific field of taxation. You will have to provide relevant and up-to-date advice on tax issues ensuring tax compliance and optimization for individuals or organizations.

Forensic Accounting

Forensic accountants detect and prevent fraud in financial practices. You may find job opportunities as a forensic accountant, fraud consultant, and forensic investigator.

As a forensic accountant, you would use forensic research to track funds and identify any misuse or negligence. You would need to analyze financial data and create reports on financial findings.

As a fraud consultant, you would need a vast knowledge of what entails fraudulent behavior. You would be required to work on various projects like intelligence gathering, identifying tax law violations, and researching embezzlement, among others.

As a forensic finance investigator, you might work with federal agencies, helping them track illegal funds and investigate white-collar crimes, among other duties.

Cost Accounting

Cost accounting is included in the managerial form of accounting.

Cost accountants locate and interpret the necessary cost information to capture a company's total cost of production and operations, and assess the variable and fixed costs incurred.

Financial Analysis

Financial analysts typically work for investment firms, helping companies identify good investment opportunities. This often involves looking through financial statements and other careful analyses of a company’s financial situation to ensure that investors should buy shares.

Compliance

Compliance is similar to auditing in that it entails ensuring companies and individuals follow rules and regulations.

However, working in compliance often involves thinking outside the box, both designing and monitoring processes to help a business stay on the right side of the law.

Financial Planning

Financial planners help individuals manage their money and reach their financial goals. You may help people build budgets, save for retirement, and file their taxes at the end of each year. -

Obtain an Internship

An internship will help you gain great experience, network within your industry, and improve your chances for full-time work. Many accounting interns get offered jobs after their internship. Start looking for internship opportunities halfway through your degree. You might work part-time for an accounting firm, or full-time for a summer student opportunity.

-

Complete Your Bachelor’s Degree

Work on getting your GPA as high as possible and complete your accounting degree. Make sure you check your university’s requirements for graduation when it comes to GPA and course credits.

-

Look for Work

Armed with a bachelor’s degree and internship experience, you shouldn’t have any trouble finding an entry-level accounting job. Check job boards and any university alumni resources, and reach out to any network contacts you may have. If you want to pursue your CPA, you can take extra credits required while you work.

-

Pick a Certification

Now that you have some work experience in accounting, you might have a solid idea of what you want to specialize in. Certification helps you secure higher-paying roles and credibility within your industry.

Here are some accounting certifications you might consider:

Certified Public Accountant (CPA): CPAs are accounting specialists that file accounting and tax reports with the Securities and Exchange Commission. You need to pass a few exams and complete specialized coursework to become a CPA. Most CPAs make a formidable salary, higher than the average accountant.

Certified Management Accountants: If you pass an exam from the Institute of Management Accountants, you can receive this certification.

Certified Internal Auditors: These specialists must complete an exam from the Institute of Internal Auditors. In their careers, they may audit businesses, individuals, and government agencies.

Certified Information Systems Auditors: If you spent time working as an accountant in the information systems field, you can take an exam to become a certified specialist.

-

Consider Further Education

To keep up with the latest accounting trends, continuing education is key. Earning a certification or a master’s degree in an accounting specialization can help boost your job prospects. The most successful of accountants never put a stop to their studies. Here are some topics you can hone in on through graduate education.

Master’s Degree in Accounting

Most accounting master’s programs are between 1-2 years. Some topics prospective accountants and current accountants might study in their master’s program include auditing, corporate finance, investments, and securities.

Doctorate Degree in Accounting

A Ph.D. in accounting usually takes between 4-5 years of full-time study. Some topics include:

Accounting and Business: advanced financial reporting, business management, advanced decision models

Economics and Statistics: game theory, probability, linear statistical models

Research Methods: advanced accounting, behavioral research in accounting, capital market research in accounting

How Long Does it Take to Become an Accountant?

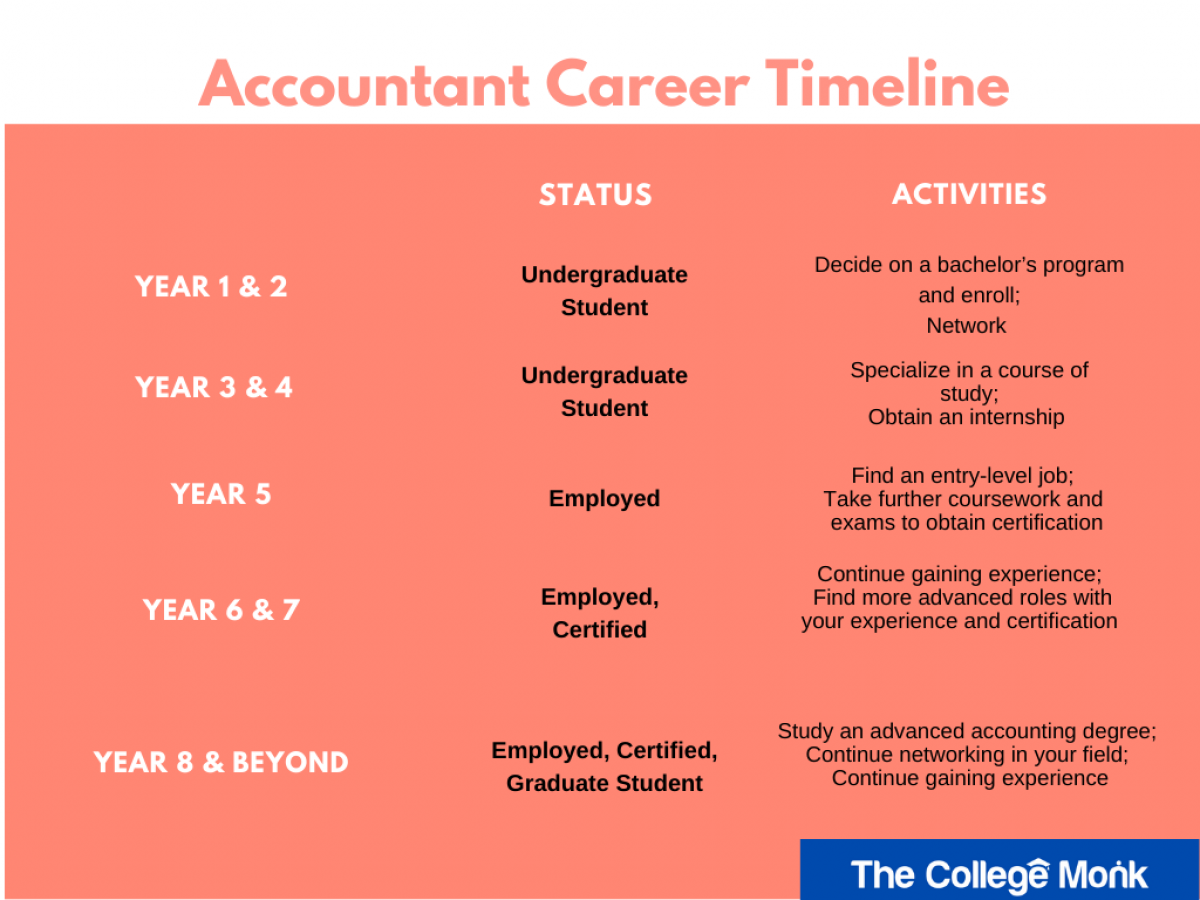

To become an accountant, it takes about 5 years. Add on an extra year or two to obtain your desired certification, and an extra 2-6 years if you wish to pursue graduate education.

Here’s a breakdown of the timeline in becoming an accountant:

How Much Money Does an Accountant Make?

Accountant salaries depend on:

- experience

- field of specialization

- certification

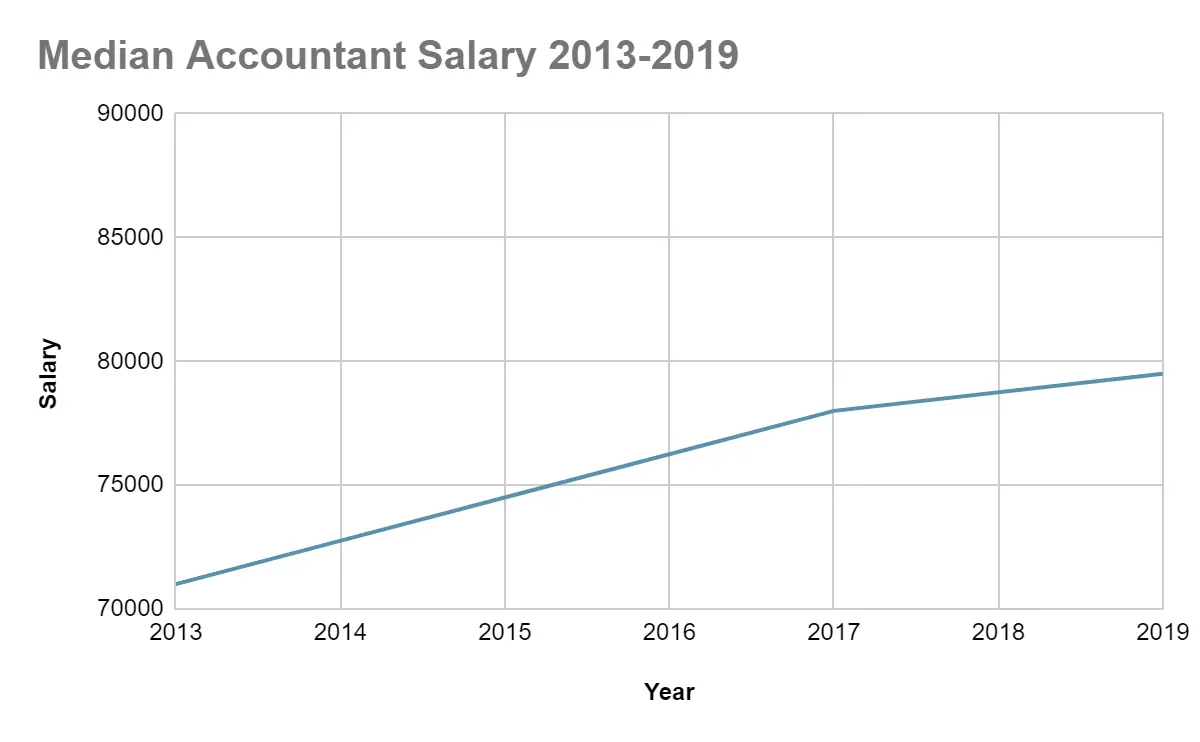

In 2019, the median accountant salary was about $71,000. Their salaries tend to increase with time and with inflation.

Here’s a chart showing the increase in accountant salaries over the years:

Note: Graph values rounded.

Source: https://money.usnews.com/careers/best-jobs/accountant/salary

The above values are median salary amounts for the average accountant. You can expect these salaries to be higher for accountants that work in their field for a while and accountants that obtain certifications.

Do I Need a Degree to Become an Accountant?

You might be wondering how to become an accountant without a degree. It is possible, though difficult, to find a career in accounting without a degree. Many colleges offer bookkeeping diplomas. Additionally, you can learn your craft by starting in a non-accounting role within a firm and working your way up, with the guidance of a mentor.

However, if you want to become a CPA or other specialized accountant, you will need a bachelor’s degree.

Conclusion

While the world of accounting may seem stuffy and boring, many will thrive in the world of financial management, taxes, investments, and numbers!

Accountants have a huge variety of career paths available to them and can enjoy working in a relatively stable industry.

You might find it rewarding to help people and businesses achieve their financial goals or to ensure tax compliance across the finance sector.

Check out our list of the best accounting colleges to find out more about the field of accounting!